Essay

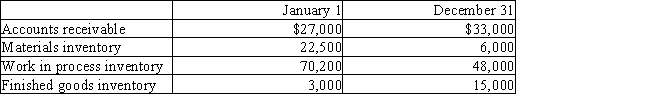

Davis Manufacturing Company had the following data:

Collections on account were $625,000.

Collections on account were $625,000.

Cost of goods sold was 68% of sales.

Direct materials purchased amounted to $90,000.

Factory overhead was 300% of the cost of direct labor.

Compute:

(a)Sales revenue (all sales were on account)

(b)Cost of goods sold

(c)Cost of goods manufactured

(d)Direct labor used

(e)Direct materials incurred

(f)Factory overhead incurred

Correct Answer:

Verified

(a)Sales revenue = $33,000 + $625,000 - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Sustainability information can provide important feedback to

Q27: What is decision making? Who is responsible

Q35: A cost can be a payment of

Q60: Conversion costs are the combination of direct

Q117: Use the information below for Jensen

Q125: Differentiate between:<br>a) direct materials versus indirect materials<br>b)

Q151: The cost of a manufactured product generally

Q164: Period <br>(nonmanufacturing) costs are classified into two

Q185: For each of the following, indicate whether

Q239: Beginning work in process is equal to<br>A)