Essay

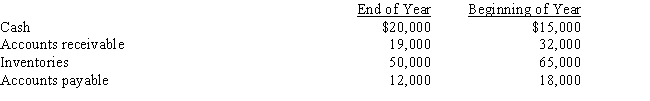

The Dickinson Company reported net income of $155,000 for the current year.Depreciation recorded on buildings and equipment amounted to $65,000 for the year.In addition,a building with an original cost of $250,000 and accumulated depreciation of $190,000 on the date of the sale,was sold for $75,000.Balances of the current asset and current liability accounts at the beginning and end of the year are as follows:

Prepare the cash flows from the operating activities section of the statement of cash flows using the indirect method.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Land costing $140,000 was sold for $173,000

Q34: To determine cash payments for income taxes

Q61: Cash inflows and outflows are not netted

Q74: On the statement of cash flows, the

Q86: The statement of cash flows shows the

Q104: Which of the following is a noncash

Q105: Cash paid to acquire treasury stock should

Q133: For each of the following activities that

Q152: The cash flows from operating activities are

Q152: If a business issued bonds payable in