Essay

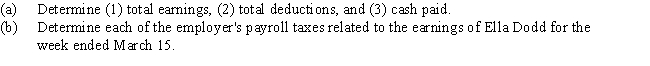

The following information is for employee Ella Dodd for the week ended March 15.

Total hours worked: 48

Rate: $15 per hour,with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% with no maximum earnings.

Medicare tax: 1.5% on all earnings.

State unemployment: 3.4% with no maximum earnings; on employer

Federal unemployment: 0.8% with no maximum earnings; on employer

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Which of the following are included in

Q16: On January 1, Year 1, Zero Company

Q46: Federal income taxes are subject to a

Q65: Nelson Industries warrants its products for one

Q66: The summary of the payroll for the

Q68: Based on the following data,what is the

Q74: According to a summary of the payroll

Q82: Assuming a 360-day year, proceeds of $48,750

Q149: Estimating and recording product warranty expense in

Q175: FICA tax is a payroll tax that