Essay

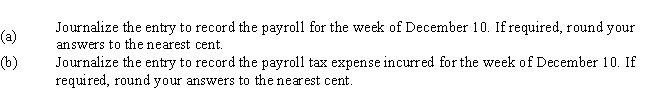

Townson Company had gross wages of $180,000 during the week ended December 10.All earnings are subject to social security tax,while the amount of wages subject to federal and state unemployment taxes was $24,000.Tax rates are as follows:

The total amount withheld from employee wages for federal income taxes was $32,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Use the following key (a-d) to identify

Q36: The interest portion of an installment note

Q124: Scott Company sells merchandise with a one-year

Q143: Use the following key (a-d) to identify

Q152: The journal entry to record the

Q158: List five internal controls that relate directly

Q160: Several months ago,Jones Company experienced a spill

Q163: Lamar Industries warrants its products for one

Q166: The following totals for the month of

Q183: Chang Co. issued a $50,000, 120-day, discounted