Essay

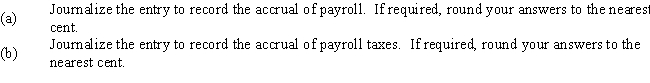

According to a summary of the payroll of Scotland Company,salaries for the period were $500,000.Federal income tax withheld was $98,000.Also,$15,000 was subject to state (4.2%)and federal (0.8%)unemployment taxes.All earnings are subject to social security tax of 6.0% and Medicare tax of 1.5%.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: On January 1, Gemstone Company obtained a

Q28: Martinez Co. borrowed $50,000 on March 1

Q29: Federal unemployment taxes are paid by the

Q88: In order to be a recorded contingent

Q156: The journal entry a company uses to

Q178: On January 1,Zero Company obtained a $52,000,4-year,6.5%

Q191: The amount borrowed is equal to the

Q192: The proceeds from discounting a $20,000, 60-day

Q196: Payroll taxes only include social security taxes

Q201: Use this information for Harris Company