Essay

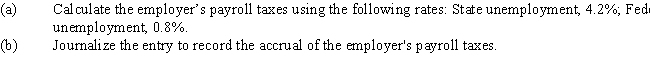

According to a summary of the payroll of Sinclair Company,$545,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax.Also,$10,000 was subject to state and federal unemployment taxes.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: On January 1, Year 1, Zero Company

Q39: A pension plan that requires the employer

Q55: A current liability is a debt that

Q60: Several months ago,Maximilien Company experienced a spill

Q65: Nelson Industries warrants its products for one

Q66: The summary of the payroll for the

Q149: Vacation pay payable is reported on the

Q151: Assuming a 360-day year, when a $50,000,

Q165: Wright Company sells merchandise with a one-year

Q175: FICA tax is a payroll tax that