Essay

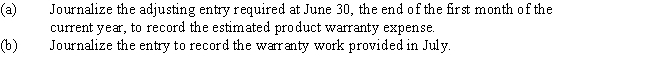

Hadley Industries warrants its products for one year.The estimated product warranty expense is 4% of sales.Assume that sales were $210,000 for June.In July,a customer received warranty repairs requiring $205 of parts and $75 of labor.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Which of the following is required to

Q55: Sadie White receives an hourly rate of

Q112: Hall Company sells merchandise with a one-year

Q113: The following totals for the month of

Q115: Assume that social security taxes are payable

Q133: On August 1, Batson Company issued a

Q135: On June 8, Williams Company issued an

Q173: Most employers are required to withhold federal

Q181: Federal unemployment compensation taxes that are collected

Q187: Federal income taxes withheld increase the employer's