Multiple Choice

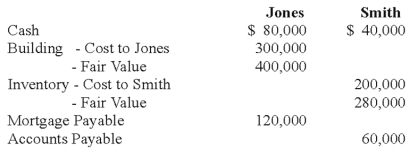

Jones and Smith formed a partnership with each partner contributing the following items:

Assume that for tax purposes Jones and Smith agree to share equally in the liabilities assumed by the Jones and Smith partnership.

-Refer to the above information.What is the balance in each partner's capital account for financial accounting purposes?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q3: When a new partner is admitted into

Q16: Net income for Levin-Tom partnership for 2009

Q20: In the AD partnership,Allen's capital is $140,000

Q23: The APB partnership agreement specifies that partnership

Q24: In the AD partnership,Allen's capital is $140,000

Q26: In the AD partnership,Allen's capital is $140,000

Q32: Which of the following statements best describes

Q35: Shue,a partner in the Financial Brokers Partnership,has

Q58: In the AD partnership,Allen's capital is $140,000

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the