Multiple Choice

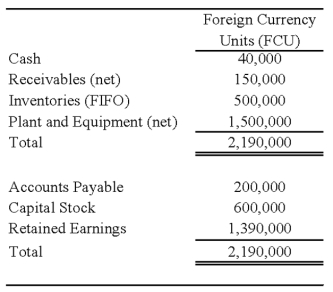

On January 2,20X8,Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Perth's balance sheet contained the following information:

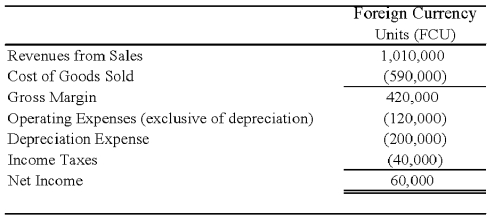

Perth's income statement for 20X8 is as follows:

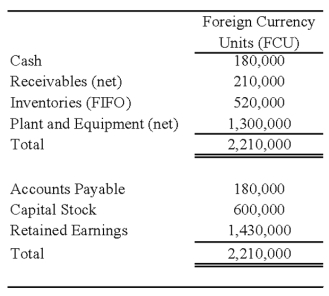

The balance sheet of Perth at December 31,20X8,is as follows:

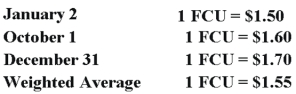

Perth declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Perth declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Perth's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the local currency of the country in which Perth Company is located is the functional currency,what are the translated amounts for the items below in U.S.dollars?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q12: For each of the items listed below,state

Q12: All of the following describe the International

Q17: The balance in Newsprint Corp.'s foreign exchange

Q18: Refer to the information in question 52.Assume

Q19: Use the information given in question 52

Q28: If the U.S.dollar is the currency in

Q34: On September 30, 20X8, Wilfred Company sold

Q42: On September 30, 20X8, Wilfred Company sold

Q56: All of the following stockholders' equity accounts

Q65: Mercury Company is a subsidiary of Neptune