Multiple Choice

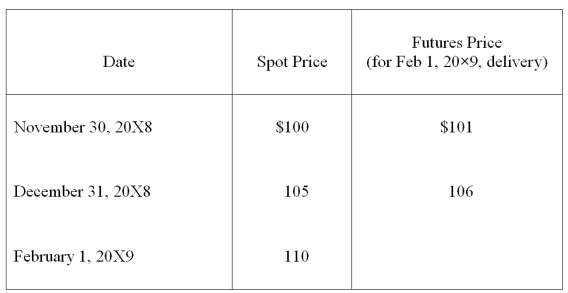

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil.On November 30,20X8,AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel,with a February 1,20X9,call date.The following is the pricing information for the term of the call:

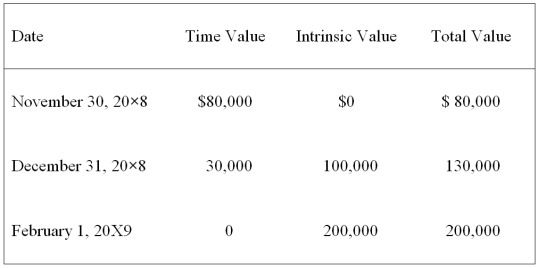

The information for the change in the fair value of the options follows:

On February 1,20X9,AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price.On April 1,20X9,AMAR sells the oil for $112 per barrel.

-Based on the preceding information,which of the following adjusting entries would be required on December 31,20X8?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Company X denominated a December 1,20X9,purchase of

Q12: Taste Bits Inc. purchased chocolates from Switzerland

Q21: Taste Bits Inc. purchased chocolates from Switzerland

Q23: Suppose the direct foreign exchange rates in

Q34: On December 1,20X8,Hedge Company entered into a

Q57: On November 1,20X8,Denver Company borrowed 500,000 local

Q59: Levin company entered into a forward contract

Q61: On December 1,2008,Secure Company bought a 90-day

Q61: On December 1, 20X8, Winston Corporation acquired

Q62: On December 1,2008,Denizen Corporation entered into a