Essay

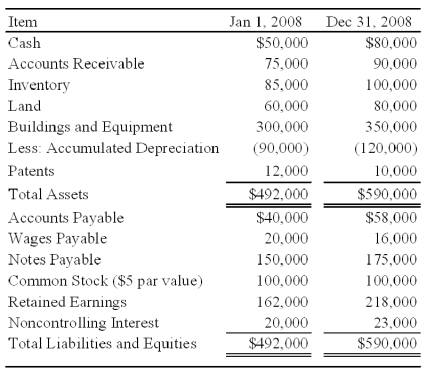

Locus Corporation acquired 80 percent ownership of Stereo Company on January 1,2006,at underlying book value.At that date,the fair value of the noncontrolling interest was equal to 20 percent of the book value of Stereo Company.Consolidated balance sheets at January 1,2008,and December 31,2008,are as follows:

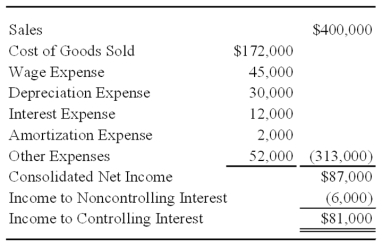

The consolidated income statement for 2008 contained the following amounts:

Locus and Stereo paid dividends of $25,000 and $15,000,respectively,in 2008.

Required:

1)Prepare a worksheet to develop a consolidated statement of cash flows for 2008 using the indirect method of computing cash flows from operations.

2)Prepare a consolidated statement of cash flows for 2008.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: On January 1,20X8,Putter Corporation acquired 40 percent

Q13: Which of the following observations concerning the

Q23: Pappas Company owns 85 percent of Sunny

Q24: For the first quarter of 20X8,Vinyl Corporation

Q29: Plush Corporation holds 80 percent of Scratch

Q30: Assume that New Life uses the direct

Q32: Company A holds 70 percent of the

Q33: Assume that New Life uses the direct

Q34: Company A owns 85 percent of Company

Q39: Pony Corporation acquired 90 percent of Saddle