Multiple Choice

Push Company owns 60% of Shove Company's outstanding common stock.

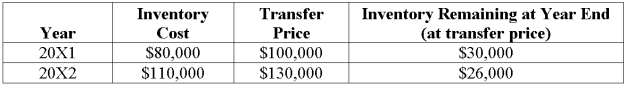

Intra-entity sales are as follows:

-Assume Shove sold the inventory to Push.

Using the fully adjusted equity method,what journal entry would be recorded by Push to defer the unrealized gross profit on inventory sales to Shove in 20X1?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q1: When there are intercompany sales of inventory

Q2: Padre Company purchases inventory for $70,000 on

Q3: Pluto Company owns 100 percent of the

Q14: Pluto Company owns 100 percent of the

Q40: When a parent and its subsidiary use

Q44: On January 1,20X8,Parent Company acquired 90 percent

Q52: Sub Company sells all its output at

Q57: Pepper Corporation owns 75 percent of Salt

Q65: Pilfer Company acquired 90 percent ownership of

Q67: Elvis Company purchases inventory for $70,000 on