Essay

On January 1,20X8,Vector Company acquired 80 percent of Scalar Company's ownership for $120,000 cash.At that date,the fair value of the noncontrolling interest was $30,000.The book value of Scalar's net assets at acquisition was $125,000.The book values and fair values of Scalar's assets and liabilities were equal,except for buildings and equipment,which were worth $15,000 more than book value.Buildings and equipment are depreciated on a 10-year basis.Although goodwill is not amortized,the management of Vector concluded at December 31,20X8,that goodwill from its acquisition of Scalar shares had been impaired and the correct carrying amount was $5,000.Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders.No additional impairment occurred in 20X9.

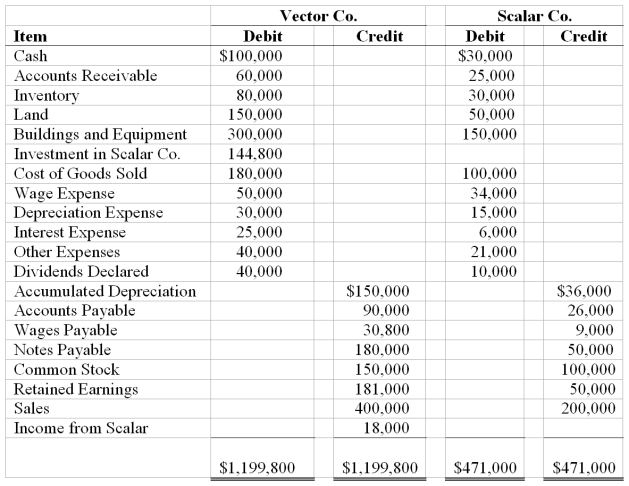

Trial balance data for Vector and Scalar on December 31,20X9,are as follows:

Required:

1)Provide all eliminating entries needed to prepare a three-part consolidation worksheet as of December 31,20X9.

2)Prepare a three-part consolidation worksheet for 20X9 in good form.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: On January 1,20X9,Pirate Corporation acquired 80 percent

Q13: The following information applies to Questions 29-31<br>On

Q14: Pink Inc.sells half of its 70% interest

Q18: Postage Corporation acquired 75 percent of Stamp

Q23: On January 1,20X8,Ramon Corporation acquired 75 percent

Q25: On January 1,20X9,Gulliver Corporation acquired 80 percent

Q30: Magellan Corporation acquired 80 percent ownership of

Q32: Based on the preceding information,what amount will

Q37: The following information applies to Questions 21-26<br>On

Q43: The following information applies to Questions 29-31<br>On