Multiple Choice

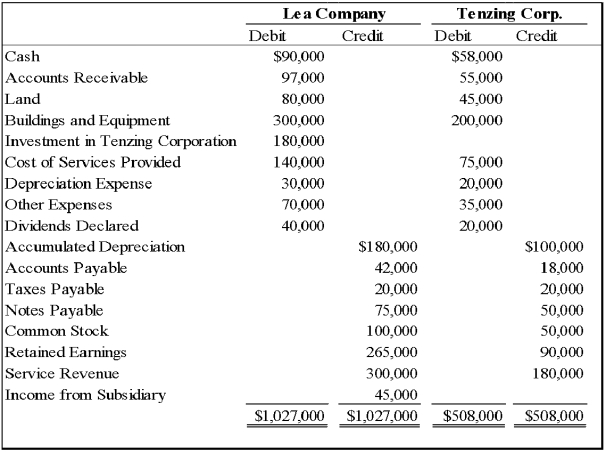

Lea Company acquired all of Tenzing Corporation's stock on January 1,20X6 for $150,000 cash.On December 31,20X8,the trial balances of the two companies were as follows:

Tenzing Corporation reported retained earnings of $75,000 at the date of acquisition.The difference between the acquisition price and underlying book value is assigned to buildings and equipment with a remaining economic life of five years from the date of acquisition.At December 31,20X8,Tenzing owed Lea $4,000 for services provided.

-Based on the preceding information,all of the following are eliminating entries required on December 31,20X8,to prepare consolidated financial statements,except:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q10: On January 1,20X9,Wilton Company acquired all of

Q11: Top Company obtained 100 percent of Bottom

Q15: On January 1,20X8,Patriot Company acquired 100 percent

Q22: Pace Corporation acquired 100 percent of Spin

Q28: Plant Company acquired all of Sprout Corporation's

Q33: On December 31,20X8,Polaris Corporation acquired 100 percent

Q37: Plant Company acquired all of Sprout Corporation's

Q44: West, Inc. holds 100 percent of the

Q57: On December 31,20X9,Pluto Company acquired 100 percent

Q65: On December 31, 20X1, Oak Corporation acquired