Essay

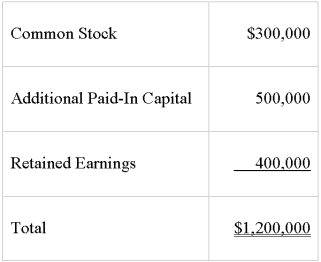

Paco Company acquired 100 percent of the stock of Garland Corp.on December 31,20X8.The stockholder's equity section of Garland's balance sheet at that date is as follows:

Paco financed the acquisition by using $880,000 cash and giving a note payable for $400,000.Book value approximated fair value for all of Garland's assets and liabilities except for buildings which had a fair value $60,000 more than its book value and a remaining useful life of 10 years.Any remaining differential was related to goodwill.Paco has an account payable to Garland in the amount of $30,000.

Required:

1)Present all eliminating entries needed to prepare a consolidated balance sheet immediately following the acquisition.

2)What additional eliminating entry must be prepared at December 31,20X9?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Consolidated financial statements are being prepared for

Q28: Which of the following is true? When

Q29: On December 31,20X9,Thessaly Corporation acquired all of

Q31: On January 1,20X8,Blake Company acquired all of

Q40: Enya Corporation acquired 100 percent of Celtic

Q46: Plant Company acquired all of Sprout Corporation's

Q47: On December 31,20X9,Pluto Company acquired 100 percent

Q49: Pace Corporation acquired 100 percent of Spin

Q50: Berlin, Inc. holds 100 percent of the

Q53: Pirate Corporation acquired 100 percent of Ship