Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

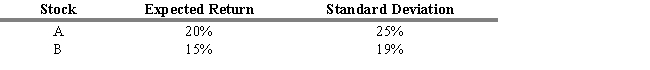

Stocks A and B have a correlation coefficient of -0.8. The stocks' expected returns and standard deviations are in the table below. A portfolio consisting of 40% of stock A and 60% of stock B is constructed.

-Refer to Exhibit 6.14. What is the expected return of the stock A and B portfolio?

A) 17.0%

B) 17.5%

C) 18.0%

D) 18.5%

E) 19.0%

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Semivariance, when applied to portfolio theory, is

Q34: Risk is defined as the uncertainty of

Q35: The most important criteria when adding new

Q36: Investors choose a portfolio on the efficient

Q37: If equal risk is added moving along

Q39: Markowitz believes that any asset or portfolio

Q40: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q41: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q42: A portfolio is efficient if no other

Q43: The correlation coefficient and the covariance are