Essay

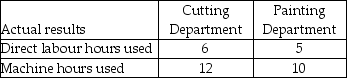

The Highland Corporation uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments-cutting and painting. The Cutting Department uses a departmental overhead rate of $15 per machine hour, while the Painting Department uses a departmental overhead rate of $9 per direct labour hour. Job 586 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 586 is $900.

Required: What was the total cost of Job 586 if the Highland Corporation used the departmental overhead rates to allocate manufacturing overhead?

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Refined costing systems can be used to

Q88: Cost distortion occurs when some products are

Q98: Use the information below to answer the

Q99: In using an ABC system, which of

Q101: Use the information below to answer the

Q102: One condition that favours using a plantwide

Q106: Companies with higher direct costs in relation

Q107: The cost of depreciation, insurance, and property

Q108: Cost distortion results in the<br>A) overcosting of

Q131: Product-level activities and costs are incurred for