Multiple Choice

Use the information below to answer the following question(s) :

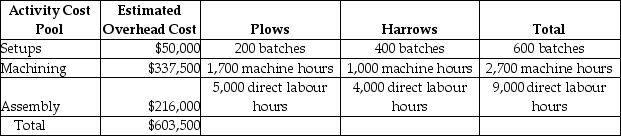

Martin Corporation manufactures two products-Plows and Harrows. The annual production and sales of Plows is 1,000 units, while 2,000 units of Harrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Plows require 5.0 direct labour hours per unit, while Harrows require 2.0 direct labour hours per unit. The total estimated overhead for the period is $603,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The predetermined overhead allocation rate using the traditional costing system would be closest to

A) $43.20 per direct labour hour.

B) $67.06 per direct labour hour.

C) $60.30 per direct labour hour.

D) $201.17 per direct labour hour.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: ABC can be used in routine planning

Q78: All of the following are activities in

Q79: The benefits of using the ABC costing

Q80: Which of the following statements does NOT

Q81: Answer the following question(s) using the information

Q84: Assuming activity-cost pools are used, what are

Q85: Clearview Display Company manufactures display cases to

Q86: Use the information below to answer the

Q87: Rhapsody Corporation manufactures several different products and

Q88: Use the information below to answer the