Multiple Choice

Use the information below to answer the following question(s) :

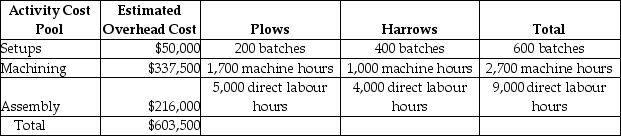

Martin Corporation manufactures two products-Plows and Harrows. The annual production and sales of Plows is 1,000 units, while 2,000 units of Harrows are produced and sold. The company has traditionally used direct labour hours to allocate its overhead to products. Plows require 5.0 direct labour hours per unit, while Harrows require 2.0 direct labour hours per unit. The total estimated overhead for the period is $603,500. The company is looking at the possibility of changing to an activity-based costing system for its products. If the company used an activity-based costing system, it would have the following three activity cost pools:

Expected Activity

-The cost pool activity rate for Machining Costs would be closest to

A) $223.52 per Machine hour.

B) $198.53 per Machine hour.

C) $125.00 per Machine hour.

D) $37.50 per Machine hour.

Correct Answer:

Verified

Correct Answer:

Verified

Q70: What is activity-based management and how can

Q144: Use the information below to answer the

Q145: Value-added activities can be described as activities

Q146: Dudley & Spahr, Attorneys at Law, provide

Q148: The storage of raw materials is considered

Q150: Which of the following describes how, in

Q151: Silver Company manufactures several different products and

Q152: Use the information below to answer the

Q153: Use the information below to answer the

Q217: The plantwide overhead cost allocation rate is