Essay

Step-Up Corporation manufactures two small step ladders, Regular and Deluxe. Deluxe ladders were added as a product line three years ago. Deluxe ladders are the more complex of the two products as they are extendable, requiring one hour of direct labour time per unit to manufacture, compared to one-half hours of direct labour time for Regular ladder.

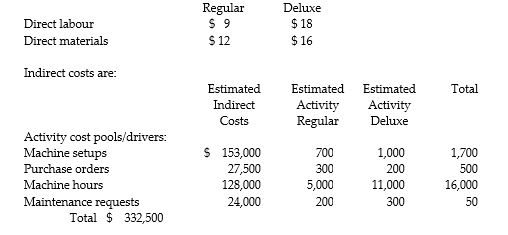

Indirect costs are currently allocated to the products on the basis of direct labour hours. The company estimated it would incur $332,500 in manufacturing overhead costs and produce 6,000 units of Deluxe ladders and 20,000 units of Regular ladders during the current year.

Unit costs for materials and direct labour are:

Required:

Required:

a. Determine the unit cost of the two products using traditional costing with units as the allocation base.

b. Determine the unit cost of the two products using activity-based costing.

Correct Answer:

Verified

a. Traditional Costi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Use the information below to answer the

Q8: Use the information below to answer the

Q9: Use the information below to answer the

Q11: Credit Valley Products manufactures its products in

Q13: Companies that use ABC trace direct materials

Q14: Use the information below to answer the

Q15: Rach & Johnson is an advertising agency.

Q16: The departmental overhead cost allocation rate is

Q17: Direct labour hours would be the most

Q24: The estimated total manufacturing overhead costs that