Multiple Choice

Use the information below to answer the following question(s) .

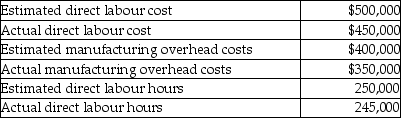

Sable Company is debating the use of direct labour cost or direct labour hours as the cost allocation base for allocating manufacturing overhead. The following information is available for the most recent year:

-If Sable Company uses direct labour cost as the allocation base, what would the predetermined manufacturing overhead rate be?

A) 70%

B) 80%

C) 89%

D) 78%

Correct Answer:

Verified

Correct Answer:

Verified

Q71: The journal entry needed to record depreciation

Q72: Fulton Corporation uses estimated direct labour hours

Q73: Lawrence Corporation had actual manufacturing overhead costs

Q74: Overallocated manufacturing overhead results when<br>A) production is

Q75: Use the information below to answer the

Q77: Use the information below to answer the

Q78: The amount of overallocation or underallocation is

Q79: Use the information below to answer the

Q80: Before the year began, Coia Manufacturing estimated

Q308: Hurley Enterprises uses job costing. Actual overhead