Multiple Choice

Use the information below to answer the following question(s) .

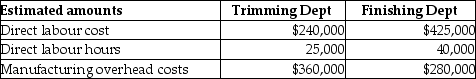

Crabtree Ornaments Company uses job costing. Crabtree Ornaments Company has two departments, Trimming and Finishing. Manufacturing overhead is allocated based on direct labour cost in the Trimming Department and direct labour hours in the Finishing Department. The following additional information is available:

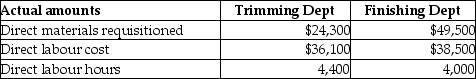

Actual data for completed Job No. 650 is as follows:

-What is the predetermined manufacturing overhead rate for the Finishing Department at Crabtree Ornaments Company?

A) $10.63 per direct labour hour

B) $11.20 per direct labour hour

C) $70.00 per direct labour hour

D) $7.00 per direct labour hour

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Stacey Enterprises uses job costing. Actual overhead

Q2: Has manufacturing overhead at Sailor Manufacturing Company

Q4: The journal entry to issue $500 of

Q5: The total cost of a job shown

Q6: Coopers & Stocker Consulting pays Kelly Yoster

Q8: Use the information below to answer

Q9: ABC uses job costing. Actual manufacturing overhead

Q10: Boyle Manufacturing has two departments that produce

Q11: Use the information below to answer the

Q277: Allocating manufacturing overhead to jobs simply means