Multiple Choice

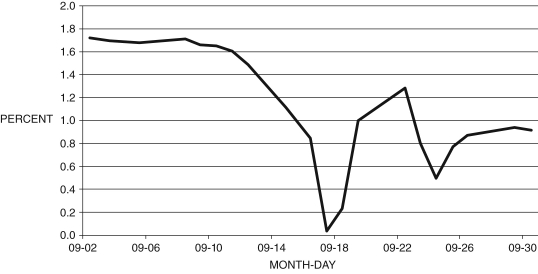

The following figure shows the daily three-month treasury yield in September 2008. Refer to the following figure when answering

Figure 10.1: Daily Three-Month Treasury Yield: September 2008  (Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

(Source: Federal Reserve Economic Data, St. Louis Federal Reserve)

-Consider the data in Figure 10.1. What does the data for mid-September in this figure suggest?

A) Increasing investor confidence in the effectiveness of TARP led to smaller purchases of U.S. treasuries.

B) There was a rapid movement of assets from treasuries to stocks.

C) In the aftermath of the collapse of Lehman Brothers investors fled to the safety of short-term treasuries.

D) Prices of gold declined in line with short-term treasury yields.

E) GM and Chrysler declared bankruptcy.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Loans, investments, and cash are on the

Q14: Between May 2004 and May 2006, the

Q16: A salve to the wounds of the

Q47: Between 1996 and 2006, housing prices averaged

Q56: Other recent financial crises occurred in:<br>A) Mexico

Q58: Refer to the following table when

Q73: The sharp swing in core inflation in

Q86: The acronym "CDO" stands for:<br>A) constant deficit

Q93: During the Great Recession, inflation was relatively

Q101: From a low of _ percent in