Multiple Choice

Consider two economies with the following IS curves,denoted 1 and 2:

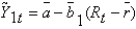

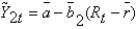

IS1:

IS2:

Given these two curves,the economies are identical except that they respond to interest rate changes differently.Suppose we assume

,b±1 = 1,

,

) If the real interest rate in each economy falls to

,then:

A) Country 1 will move from its long-run equilibrium to 1 percent above its potential and Country 2 will move from its long-run equilibrium to 0.5 percent above its potential.

B) Country 1 will move from its long-run equilibrium to 1 percent above its potential and Country 2 will move from its long-run equilibrium to -0.5 percent below its potential.

C) Country 1 will move from its long-run equilibrium to -1 percent below its potential and Country 2 will move from its long-run equilibrium to 0.5 percent above its potential.

D) Country 1 will move from 0.5 percent below its potential to its long-run equilibrium and Country 2 will move from its long-run equilibrium to 2 percent above its potential.

E) Neither country will move away from its long-run equilibrium.

Correct Answer:

Verified

Correct Answer:

Verified

Q50: Government spending designed to mitigate short-run fluctuations

Q51: When the multiplier is included in the

Q52: According to the Life Cycle hypothesis,incomes are

Q53: In the equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4305/.jpg" alt="In the

Q54: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4305/.jpg" alt=" -Consider Figure 11.2.If

Q56: Consider the following model of the IS

Q58: If there is an aggregate demand shock,

Q59: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4305/.jpg" alt=" -You are given

Q60: The foundation of the IS curve is

Q97: Agency problems occur when both parties have