Multiple Choice

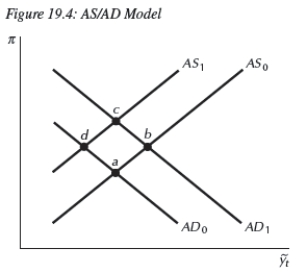

-Use the aggregate supply/aggregate demand model in Figure 19.4 to answer the following scenario.The European central bank reduces its interest rates,while the Federal Reserve maintains its federal funds rate.The economy initially moves from point __________ to point __________;eventually,the economy returns to the steady state at point __________.

A) a;d;a

B) a;d;a.

C) c;d;c

D) b;d;b

E) Not enough information is given.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In the era of floating exchange rates,currency

Q3: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4305/.jpg" alt=" -Consider Table 19.1.The

Q4: When it takes fewer euro to buy

Q5: The U.S.dollar would appreciate if:<br>A) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4305/.jpg"

Q9: Which of the following can be used

Q10: The real exchange rate can be decomposed

Q19: In the long run, what value should

Q66: The reason individuals have to trade currencies

Q78: In the long run, the nominal exchange

Q101: Buying at a low price in one