Essay

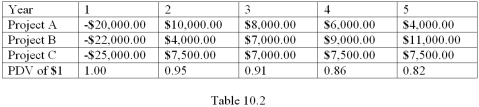

The Table 10.2 below shows net cash flows for 3 mutually exclusive projects from which a company can choose.Each project requires an investment in the first year,then produces a positive net cash flow for each of the following four years.Assuming an interest rate of 5%,which project would the company choose? Does the best project have the highest total net cash flow? The shortest payback period?

Correct Answer:

Verified

The NPV of each project is calculated in...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Durable,marketable skills that generate higher income are

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1639/.jpg" alt=" -Refer to Scenario

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1639/.jpg" alt=" -Refer to Figure

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1639/.jpg" alt=" -Table 10.1 shows

Q22: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1639/.jpg" alt=" -Refer to Figure

Q51: If you were to invest $10,000 for

Q52: If a project has an initial investment

Q53: Which of following statements about bonds is

Q56: Suppose you use the rate of inflation

Q60: Suppose the interest rate is 8%.If a