Multiple Choice

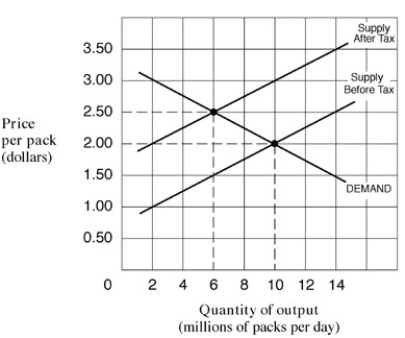

Narrbegin Exhibit 5.4 Supply and demand curves for cigarettes

-As shown in Exhibit 5.4, assume the government places a $1 per pack sales tax on cigarettes. The percentage of the burden of taxation paid by consumers of a pack of cigarettes is:

A) zero.

B) 25 per cent.

C) 50 per cent.

D) 100 per cent.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The price elasticity of demand coefficient for

Q41: Cars have higher price elasticity of demand

Q42: The less important the good is in

Q43: Suppose that when the price of a

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2058/.jpg" alt=" -Refer

Q45: If the managers of a bus system

Q47: If the price elasticity of supply equals

Q48: If a straight-line demand curve slopes down,

Q49: Narrbegin Exhibit 5.1 Demand curves <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2058/.jpg"

Q50: Narrbegin Exhibit 5.1 Demand curves <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2058/.jpg"