Multiple Choice

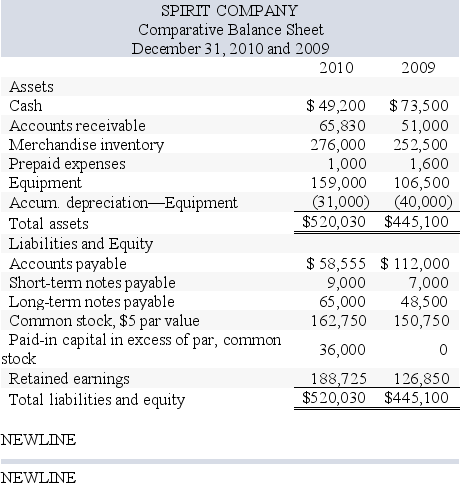

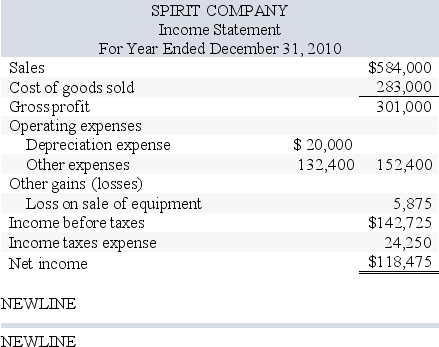

Spirit Company,a merchandiser,recently completed its 2010 calendar year .For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory,and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses.The company's balance sheet and income statement follow:

Additional Information on Year 2010 Transactions

a. The loss on the cash sale of equipment was (details in ) .

b. Sold equipment costing , for a loss of .

c. Purchased equipment costing by paying cash and signing a long-term note payable for the balance.

d. Borrowed cash by signing a short-term note payable.

e. Paid cash to reduce the long-term notes payable.

f. Issued 2,400 shares of common stock for cash per share.

g. Net income and dividends were the only items that affected retained earnings.

What is the amount of dividends declared and distributed in 2010?

A) $180,350

B) $8,375

C) $61,875

D) $56,600

E) $70,250

Correct Answer:

Verified

Correct Answer:

Verified

Q28: The first line item in the operating

Q56: Describe the format of the statement of

Q72: Use the following company information to prepare

Q80: Both the direct and indirect methods yield

Q111: The direct method for preparing and reporting

Q118: The cash flow on total assets ratio

Q126: Cash flow amounts and their timing should

Q166: The FASB requires the reporting of cash

Q207: The cash flow on total assets ratio

Q213: Financing activities include (a) the purchase and