Essay

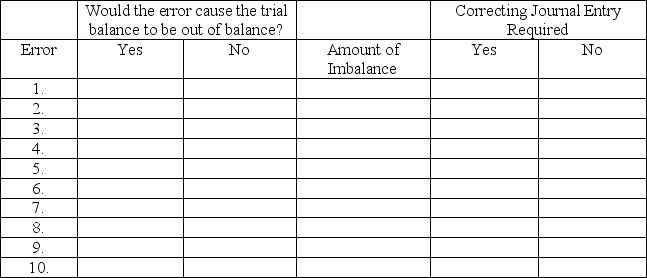

At year-end,Harris Cleaning Service noted the following errors in its trial balance:

It understated the total debits to the Cash account by $500 when computing the account balance.

1.A credit sale for $311 was recorded as a credit to the revenue account,but the offsetting

debit was not posted.

2.A cash payment to a creditor for $2,600 was never recorded.

3.The $680 balance of the Prepaid Insurance account was listed in the credit column of the

trial balance.

4.A $24,900 truck purchase for cash was recorded as a $24,090 debit to Vehicles and a

$24,090 credit to Notes Payable.

5.A purchase of office supplies for $150 was recorded as a debit to Office Equipment.The

offsetting credit entry was correct.

6.An additional investment of $4,000 by Del Harris was recorded as a debit to Common

Stock and as a credit to Cash.

7.The cash payment of the $510 utility bill for December was recorded (but not paid)twice.

8.A revenue account balance of $79,817 was listed on the trial balance as $97,817.

9.A $1,000 cash dividend was recorded as a $100 debit to Dividends and $100 credit to cash.

Using the form below,indicate whether each error would cause the trial balance to be out of balance,the amount of any imbalance and whether a correcting journal entry is required.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Which of the following statements is correct?<br>A)

Q58: On February 5,Textron Stores purchased a van

Q115: Match term to its definition

Q120: The balances for the accounts of

Q121: Double-entry accounting is an accounting system:<br>A)That records

Q122: What would be the account balance

Q124: A company paid $2,500 cash to satisfy

Q133: Asset accounts normally have credit balances and

Q135: The journal is known as the book

Q143: During the month of February, Hoffer Company