Essay

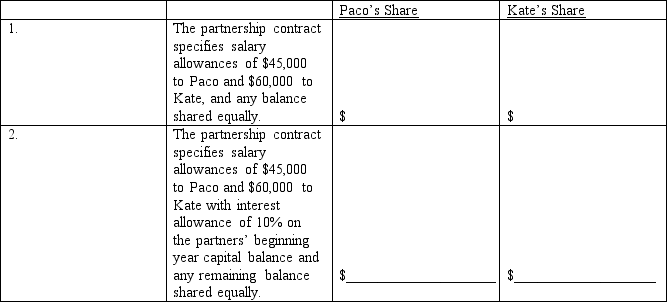

Paco and Kate invested $99,000 and $126,000,respectively,in a partnership they began one year ago.Assuming the partnership earned $120,000 during the current year,compute the share of the net income each partner should receive under each of these independent assumptions.

Correct Answer:

Verified

None...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Match each definition with its term

Q21: Groh and Jackson are partners.Groh's capital balance

Q21: Juanita invested $100,000 and Jacque invested $95,000

Q23: A partnership that has at least two

Q54: Accounting procedures for all items are the

Q82: Marquis and Bose agree to accept Sherman

Q85: Sierra and Jenson formed a partnership. Sierra

Q112: If at the time of partnership liquidation,

Q122: When a partnership is liquidated, its business

Q171: If a partner withdraws from a partnership