Essay

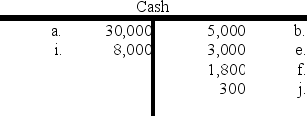

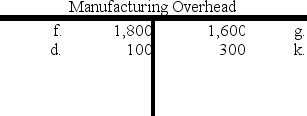

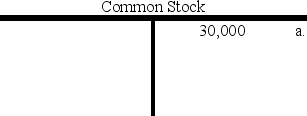

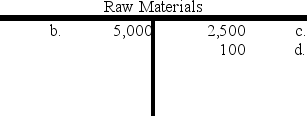

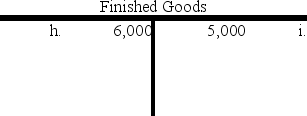

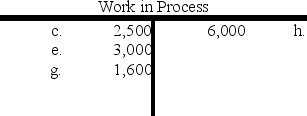

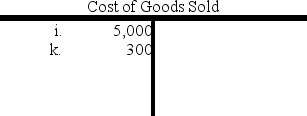

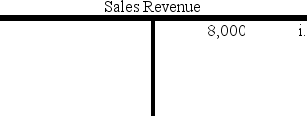

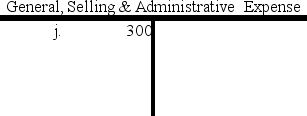

Selected accounts from Madison Company are provided below:

Required:

Required:

Determine the following:

Correct Answer:

Verified

None...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

None...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q133: Indicate whether each of the following statements

Q134: Orlando Company paid $620 cash to

Q135: Indicate whether each of the following statements

Q136: Grimes Company sold 2,500 units that had

Q137: Indicate whether each of the following statements

Q139: Travis Company had no beginning work in

Q140: Recording depreciation on manufacturing equipment will:<br>A) decrease

Q141: Manufacturing companies use a predetermined overhead rate;

Q142: The cost of indirect labor will initially

Q143: Carolina Company placed $26,500 of raw materials