Essay

Redmond Manufacturing Company began operations on January 1.The company was affected by the following events during its first year of operation:

a)Company issued stock to owners for $100,000 cash.

b)Purchased materials,$8,000 cash.

c)Transferred $4,000 of direct materials to production (Job #1: $3,000; Job #2: $1,000).

d)Paid direct labor costs,$5,000 (Job #1: $2,500; Job #2: $2,500).

e)Paid $3,000 cash for various actual overhead costs.

f)Allocated overhead to work in process at 60% of direct labor cost.

g)Completed Job #1 and transferred it to finished goods.

h)Sold Job #1 for $8,400 cash.

i)Paid $200 cash for selling and administrative expenses.

Required:

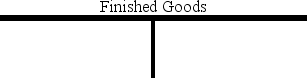

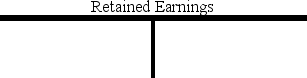

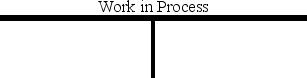

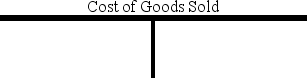

1)Record the above events in the T-accounts provided.Label your transactions (a)- (i).

2)Determine the ending balance in the Work in Process account.

3)Prepare a schedule of cost of goods manufactured and sold.

4)Compute the amount of gross profit earned on Job #1.

Correct Answer:

Verified

1)Posted T-accounts:

2)Endin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2)Endin...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: By the end of the year,Shirley Company's

Q81: A credit to the Raw Materials Inventory

Q82: Coleridge Company estimates that its production workers

Q83: All of the following costs are accumulated

Q84: Estimated overhead costs are applied to work

Q86: Purchasing production supplies for cash is a(n):<br>A)

Q87: Describe the basic differences between absorption and

Q88: Lewes Company produced 8,000 units of inventory

Q89: Recognizing estimated manufacturing overhead costs at the

Q90: Indicate whether each of the following statements