Essay

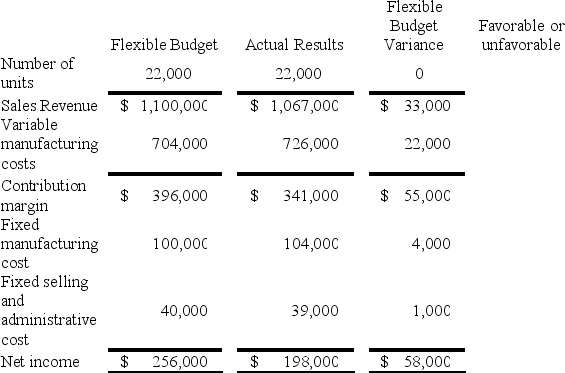

Douglas Company provided the following budgeted information for the current year.

Douglas predicted that sales would be 20,000 units,but the sales actually were 22,000 units.The actual sales price was $48.50 per unit,and the actual variable manufacturing cost was $33 per unit.Actual fixed manufacturing cost and fixed selling and administrative cost were $104,000 and $39,000,respectively.

Required:

(a)Using the form below,prepare a flexible budget,show actual results,calculate the flexible budget variances,and indicate whether the variances are favorable (F)or unfavorable (U).

(b)Assess the company's performance compared to the flexible budget.

(b)Assess the company's performance compared to the flexible budget.

Correct Answer:

Verified

(a)

(b)The company's performance did n...

(b)The company's performance did n...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: A static budget is one that shows

Q6: Lax standards make allowances for normal material

Q7: Which of the following reason(s)cause flexible budgets

Q8: Indicate whether each of the following statements

Q9: The Ferguson Company estimated that October sales

Q11: Stafford Company prepared a static budget

Q12: Burruss Company developed a static budget

Q13: Describe several factors that should be considered

Q14: When would a sales variance be listed

Q15: Global Company makes a product that is