Multiple Choice

Which of the following journal entries would be recorded if Christy Jones Company received a $3,000 cash contribution from the owner?

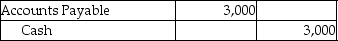

A)

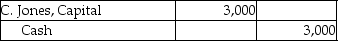

B)

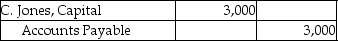

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: Data from a trial balance is used

Q24: Source documents provide the evidence and data

Q38: When a business makes a cash payment,the

Q130: A business makes a payment in cash

Q131: The ability of a company to repay

Q132: Which of the following journal entries would

Q133: At the end of a month,a business

Q136: The following transactions for the month of

Q138: A business renders services to its customer

Q140: A business renders services to a client