Essay

The accounting records of Marcus Service Company include the following selected,unadjusted balances at June 30: Accounts Receivable,$2,700;Office Supplies,$1,800;Prepaid Rent,$3,600;Equipment,$15,000;Accumulated Depreciation - Equipment,$1,800;Salaries Payable,$0;Unearned Revenue,$2,400;Office Supplies Expense,$2,800;Rent Expense,$0;Salaries Expense,$15,000;Service Revenue,$40,500.

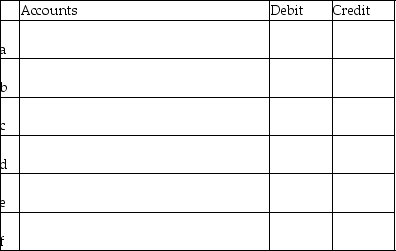

The following data developed for adjusting entries are as follows:

a.Service revenue accrued,$1,400

b.Unearned Revenue that has been earned,$800

c.Office Supplies on hand,$700

d.Salaries owed to employees,$1,800

e.One month of prepaid rent has expired,$1,200

f.Depreciation on equipment,$1,500

Journalize the adjusting entries.Omit explanations.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: The time period concept states that _.<br>A)

Q61: The sum of all the depreciation expenses

Q78: A company receives payment from one of

Q79: A business purchased equipment for $120,000 on

Q80: The entry to record depreciation includes a

Q84: The following extract was taken from the

Q86: Generally Accepted Accounting Principles (GAAP)require the use

Q87: Laramie Company signed a contract with a

Q147: In the case of a deferred expense,the

Q197: Which of the following accounting terms assumes