Multiple Choice

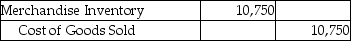

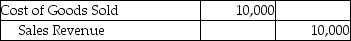

A company that uses the perpetual inventory system purchased 500 pallets of industrial soap for $10,000 and paid $750 for the freight-in.The company sold the whole lot to a supermarket chain for $14,000 on account.The company uses the specific-identification method of inventory costing.Which of the following entries correctly records the cost of goods sold?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q61: Ending inventory equals the cost of goods

Q79: Which of the following is the correct

Q108: The total cost spent on inventory that

Q149: Rodriguez,Inc.had the following balances and transactions during

Q151: In a period of rising costs,the first-in,first-out

Q154: A company that uses the periodic inventory

Q155: Universal,Inc.purchased 500 units of inventory at $25

Q157: The periodic inventory records of Zucker Sales

Q158: Metro Computer,Inc.had the following balances and transactions

Q171: A company changes its inventory costing method