Multiple Choice

Tryst,Inc.has a policy of accruing $2,400 for every employee as a vacation benefit.Sarah,an employee,took a vacation.Which of the following is the correct journal entry for the vacation benefit paid?

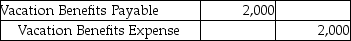

A)

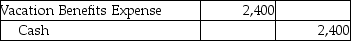

B)

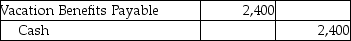

C)

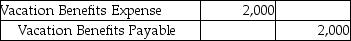

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: You have started working for a company

Q45: Regarding net pay,which of the following statements

Q54: Employer FICA is paid by the employer

Q64: The current portion of long-term notes payable

Q74: Which of the following would be included

Q86: On June 30,2017,Nightvale,Inc.purchased merchandise inventory for $500,000

Q88: Jupiter Services sells service plans for commercial

Q124: Which of the following is included in

Q179: Which of the following accounts is credited

Q205: The Social Security system is funded by