Essay

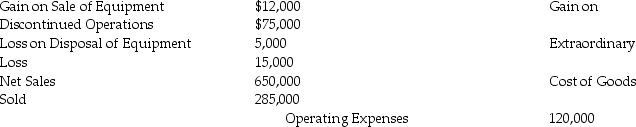

Barkin Corporation's accounting records include the following items for the year ending December 31,2017:

The income tax rate for the company is 25%.Prepare Barkin's income statement for the year ended December 31,2017.Omit earnings per share.

Correct Answer:

Verified

Other Revenues and...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Other Revenues and...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: The rate of return on total assets

Q45: Josiah,Inc.provides the following information for 2017:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5024/.jpg"

Q47: Extracts from the balance sheet of Michigan,Inc.are

Q49: Edelman,Inc.provides the following information for 2017:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5024/.jpg"

Q54: Dollar value bias is the bias one

Q56: The inventory turnover ratio measures the average

Q92: The dividend payout ratio measures the annual

Q101: The debt to equity ratio shows the

Q147: Days' sales in receivables measures the return

Q248: The income from continuing operations helps investors