Multiple Choice

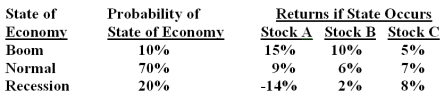

What is the standard deviation of a portfolio which is invested 20% in stock A,30% in stock B and 50% in stock C?

A) 0.6%

B) 0.9%

C) 1.8%

D) 2.2%

E) 4.9%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: A portfolio is entirely invested into Buzz's

Q11: A security that is fairly priced will

Q13: Diversification can effectively reduce risk.Once a portfolio

Q15: The expected return on a stock that

Q29: Risk that affects at most a small

Q68: The variance of Stock A is .004,the

Q86: A risk that affects a large number

Q97: The Capital Market Line is the pricing

Q117: The measure of beta associates most closely

Q122: What is the standard deviation of a