Multiple Choice

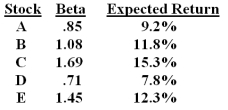

Which one of the following stocks is correctly priced if the risk-free rate of return is 3.6% and the market rate of return is 10.5%?

A) A

B) B

C) C

D) D

E) E

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: The rate of return on the common

Q10: A portfolio is:<br>A) a group of assets,

Q29: The expected return on Quantpiks is:<br>A)3.3%<br>B)8.5%<br>C)12.5%<br>D)20.5%<br>E)None of

Q35: The total number of variance and covariance

Q45: According to the Capital Asset Pricing Model:<br>A)

Q50: The stock of Big Joe's has a

Q51: A typical investor is assumed to be:<br>A)

Q60: We routinely assume that investors are risk-averse

Q69: The risk premium for an individual security

Q110: If investors possess homogeneous expectations over all