Multiple Choice

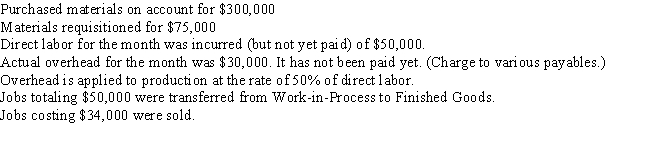

Wealth Company has the following transactions for the month of November:

Balances at the beginning of the month were:

- What is the ending balance of Finished Goods?

A) $23,321

B) $28,000

C) $64,321

D) $0

E) $10,040

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Actual overhead costs are accumulated in the

Q7: Jack's Water Slides makes custom water slides

Q8: When a job costing $5,000 is completed,

Q9: Which of the following statements is true

Q10: The overhead variance is least likely to

Q12: Manufacturing overhead<br>A) consists of all costs other

Q13: Freshy Milk Company produces dairy equipment.Most of

Q14: The _ method of allocation of support

Q15: Match the following cost flows with the

Q16: Match each item with the correct statement