Multiple Choice

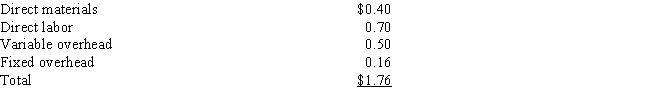

Elite Inc.has many divisions that are evaluated on the basis of return on investment (ROI) .One division, Beta, makes boxes.A second division, Lambda, makes chocolates and needs 90,000 boxes per year.Beta incurs the following costs for one box:

Beta has the capacity to make 720,000 boxes per year.Lambda currently buys its boxes from an outside supplier for $2.00 each (the same price that Beta receives) .

-Assume that Elite Inc.mandates that any transfers take place at full manufacturing cost. What would be the transfer price if Beta transferred boxes to Lambda?

A) $1.35

B) $1.76

C) $1.00

D) The transfer price cannot be determined from the information given.

E) $0.90

Correct Answer:

Verified

Correct Answer:

Verified

Q118: If the operating asset turnover ratio increased

Q119: Which of the following is not an

Q120: Residual income is the difference between operating

Q121: Economic Value Added is residual income with

Q122: Quinn Inc.has a number of divisions.One division,

Q124: Which of the following is an absolute

Q125: Select the term from below to match

Q126: Last week, Davis worked for 50 hours

Q127: In negotiated transfer pricing, the buying division

Q128: Select the appropriate definition for each of