Multiple Choice

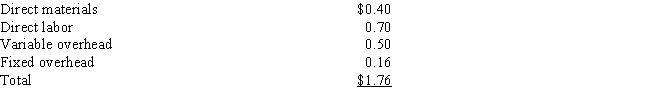

Elite Inc.has many divisions that are evaluated on the basis of return on investment (ROI) .One division, Beta, makes boxes.A second division, Lambda, makes chocolates and needs 90,000 boxes per year.Beta incurs the following costs for one box:

Beta has the capacity to make 720,000 boxes per year.Lambda currently buys its boxes from an outside supplier for $2.00 each (the same price that Beta receives) .

- Assume that Elite Inc.allows division managers to negotiate transfer price.Beta is producing 720,000 boxes.If Beta and Lambda agree to transfer boxes, what is the floor of the bargaining range and which division sets it?

A) $2.00; Beta

B) $1.35; Beta

C) $1.48; Lambda

D) $1.35; Lambda

E) $1.80; Lambda

Correct Answer:

Verified

Correct Answer:

Verified

Q79: Economic value added (EVA) is similar to

Q80: Decentralization is usually achieved by creating units

Q81: Which of the following formulas measures turnover?<br>A)

Q82: Transfer pricing is a complex issue.

Q83: Quinn Inc.has a number of divisions.One division,

Q85: Which of the following is true of

Q86: Atlas Company provided the following information

Q87: Atlas Company provided the following information

Q88: Select the appropriate definition for each of

Q89: Division A had ROI of 15% last