Multiple Choice

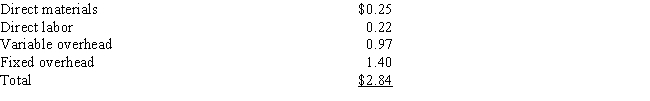

Full Serve Inc.has a number of divisions.One division, Gamma, makes zippers that are used in the manufacture of boots.Another division, Delta, makes boots that use the zippers and needs 95,000 zippers per year.Gamma incurs the following costs for one zipper:

Full Serve has the capacity to make 960,000 zippers per year, but due to a soft market, it only plans to produce and sell 630,000 zippers next year.Delta currently buys zippers from an outside supplier for $4.00 each (the same price that Gamma receives) .

- Assume that Full Serve allows negotiated transfer pricing.What is the ceiling of the bargaining range and which division sets it?

A) $3.50; Gamma

B) $4.00; Delta

C) $2.70; Gamma

D) $2.70; Delta

E) $1.38; Gamma

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The net income reduced by the total

Q3: Decentralization usually is achieved by creating units

Q4: The Balanced Scorecard perspective that defines the

Q5: The manager of Synergy Company's Stock Division

Q6: Which of the following is a disadvantage

Q7: The level of the transfer price can

Q8: The strategic management system that translates an

Q9: Unlike ROI, residual income does not encourage

Q10: The _ is a strategic management system

Q11: The manager of Synergy Company's Stock Division