Multiple Choice

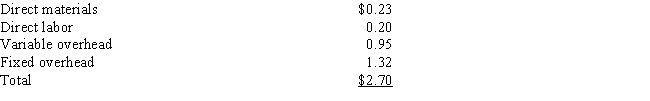

Quinn Inc.has a number of divisions.One division, Style, makes zippers that are used in the manufacture of boots.Another division, LeatherStuff, makes boots that use the zippers and needs 90,000 zippers per year.Style incurs the following costs for one zipper:

Quinn has capacity to make 950,000 zippers per year, but due to a soft market, only plans to produce and sell 620,000 zippers next year.LeatherStuff currently buys zippers from an outside supplier for $3.50 each (the same price that Style receives)

- Assume that Style and LeatherStuff have agreed on a transfer price of $3.25.What is the total benefit for Quinn, Inc.?

A) $22,500

B) $292,500

C) $163,000

D) $169,000

E) $190,800

Correct Answer:

Verified

Correct Answer:

Verified

Q57: The price charged for the transferred good

Q58: The practice of delegating decision-making authority to

Q59: Select the term from below to match

Q60: The difference between realization and sacrifice defines<br>A)

Q61: In _ decision making, decisions are made

Q63: The Balanced Scorecard perspective that defines the

Q64: The following information pertains to the three

Q65: A _ is the price charged for

Q66: If there is a competitive outside market

Q67: Turnover is the ratio of sales to