Multiple Choice

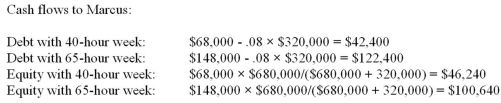

Marcus owns and manages OLK which is an all-equity firm.If he works 40 hours a week,the firm's annual EBIT will be $68,000.If he increases his hours to 65 a week,EBIT will increase to $148,000.The firm has a current value of $680,000.Marcus wants to expand the business and needs $320,000 to do so.The firm can borrow the needed funds at an interest rate of 8 percent or it can issue equity.Ignore taxes.Marcus will prefer:

A) debt with a 40-hour week as that option provides him with the highest cash flow.

B) debt with a 65-hour week as his cash flow will be $11,000 greater than his next best option.

C) equity with a 65-hour week as his cash flow will be $100,640.

D) equity with a 40-hour week as that option provides him with the highest cash flow.

E) debt with a 65-hour week as his cash flow will be $21,760 higher than if he works 65 hours and shares his equity.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: A legal attempt to financially restructure a

Q25: Cool Refreshments has bonds outstanding with a

Q29: The pecking order states how financing should

Q31: Which one of the following is true?<br>A)A

Q32: Which of these represent indirect costs of

Q33: Which one of these relationships will exist

Q35: In principle,when does a firm become bankrupt?<br>A)When

Q36: In a world with corporate taxes,MM theory

Q54: The complete termination of a firm as

Q55: Which one of these statements is correct?<br>A)Only