Multiple Choice

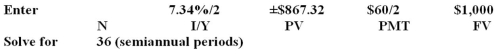

A $1,000 face value bond has a current market price of $867.32,a coupon rate of 6 percent,a yield to maturity of 7.34 percent,and semiannual interest payments.How many years is it until this bond matures?

A) 16 years

B) 18 years

C) 24 years

D) 30 years

E) 36 years

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: Two of the primary differences between a

Q33: A U.S.Treasury bond has a face value

Q34: A Treasury bond is quoted at a

Q35: Identify at least five factors that affect

Q35: A "make-whole" call provision on a bond

Q37: Webster's has a 12-year bond issue outstanding

Q39: Today,July 15,you are buying a bond from

Q40: A 25-year zero coupon bond with a

Q41: For tax purposes,the implicit annual interest for

Q78: All else constant,a coupon bond that is