Multiple Choice

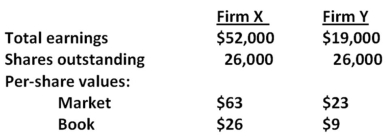

Consider the following premerger information about Firm X and Firm Y:

Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $3 per share.Also assume that neither firm has any debt before or after the merger.What is the value of the total equity of the combined firm,XY,if the purchase method of accounting is used?

A) $1,274,000

B) $1,316,000

C) $1,352,000

D) $1,422,000

E) $1,427,000

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Firms can frequently create synergy by merging

Q37: Aardvark Enterprises has agreed to be acquired

Q46: Which one of the following pairs of

Q59: Down River Markets has decided to acquire

Q62: If a firm sells its crown jewels

Q62: Firm B is being acquired by Firm

Q72: Some Freight Line Express shareholders are very

Q75: Assume the following balance sheets are stated

Q75: Rosie's has 1,800 shares outstanding at a

Q89: Alpha is planning on merging with Beta.Alpha