Multiple Choice

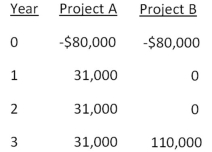

-You are considering two mutually exclusive projects with the following cash flows.Which project(s) should you accept if the discount rate is 8.5 percent? What if the discount rate is 13 percent?

A) accept project A as it always has the higher NPV

B) accept project B as it always has the higher NPV

C) accept A at 8.5 percent and B at 13 percent

D) accept B at 8.5 percent and A at 13 percent

E) accept B at 8.5 percent and neither at 13 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Scott is considering a project that will

Q19: You're trying to determine whether to expand

Q20: You are considering the following two mutually

Q21: The relevant discount rate for the following

Q22: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -You are analyzing

Q27: Which two methods of project analysis were

Q38: The internal rate of return: <br>A) may produce

Q42: You are viewing a graph that plots

Q49: Which of the following are definite indicators

Q81: J&J Enterprises is considering an investment that