Multiple Choice

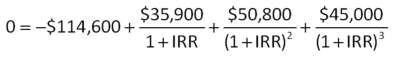

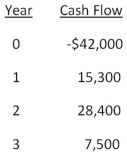

-An investment has the following cash flows and a required return of 13 percent.Based on IRR,should this project be accepted? Why or why not?

A) No;The IRR exceeds the required return by about 0.06 percent.

B) No;The IRR is less than the required return by about 1.53 percent.

C) Yes;The IRR exceeds the required return by about 0.06 percent.

D) Yes;The IRR exceeds the required return by about 1.53 percent.

E) Yes;The IRR is less than the required return by about 0.06 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q45: The final decision on which one of

Q48: If a firm accepts Project A it

Q50: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -You are analyzing

Q51: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -What is the

Q57: The length of time a firm must

Q58: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5617/.jpg" alt=" -You are analyzing

Q61: An investment project provides cash flows of

Q68: You are considering a project with an

Q93: Tedder Mining has analyzed a proposed expansion

Q98: The length of time a firm must